The Employee Retirement Income Security Act (ERISA) is federal legislation that establishes a minimum standard for pension plans. ERISA applies only to employers who offer pension plans and does not require that an employer have a pension plan.

ERISA details the kinds of information and notifications an employer with a pension plan is required to provide to participants, as well as establishing minimum standards for participation, accountability of plan managers, and the right to sue for benefits and breach of fiduciary duty.

There are myriad disclosure requirements for employers under ERISA. Depending on the type of benefits and/or pension plan being offered participants, different types and levels of notification are required. Generally, employers obligated under ERISA must disclose a description of the health benefits and/or pension plan, a description of any changes to the health benefits and/or pension plan, an annual summary report, COBRA notices (including availability and unavailability), and notices of determination decisions (creditable coverage, preexisting condition coverage, special enrollment rights, wellness program, etc.) to participants.

In order to demonstrate compliance with ERISA law, an employer must certify that participants received compliant notifications and disclosures. An employer must also track the timeframe of notifications and disclosures, as there are strict guidelines regarding when notifications and disclosures must be sent out.

How DocRead can help

DocRead is compliance software that works with SharePoint to enable an employer to disseminate compliance documentation to various user groups, receive time-stamped certification that it has been read, and monitor the progress of the document’s receipt.

ERISA regulations mandate a significant number of highly time-sensitive notifications, which create a lot of paperwork to track and maintain. DocRead establishes a paperless environment in which compliant disclosures and notifications are distributed to appropriate health benefits or pension plan participants and acknowledged within a designated timeframe.

DocRead allows the employer to choose the appropriate notification or disclosure document to distribute and the appropriate group of participants to receive the document. DocRead then notifies each participant of an assigned reading task.

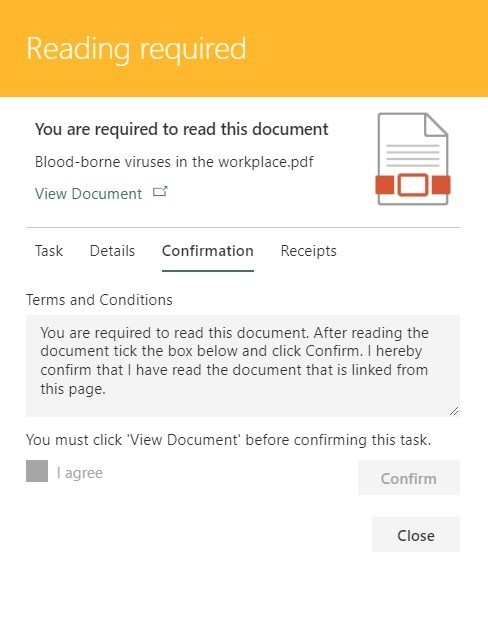

Participants are required to read the document and certify that they have understood it. They must check the 'I agree' box and then click the 'confirm' button.

Each document’s certification message is fully configurable so it can be tailored to meet your specific requirements.

Should a participant fail to read and acknowledge a disclosure or notification within the designated timeframe, DocRead will send e-mail reminders to the participant stating that a reading task is overdue.

DocRead allows participants to print out the assigned disclosure or notification for their records, and once they have acknowledged their acceptance of the notification, they also receive a time-stamped reading receipt that they may download or print. Reading receipts are also securely stored in a central database, allowing quick access and time-stamped verification of employer compliance.

DocRead also provides reading reports that can be used to monitor the progress of notification acknowledgement, clearly outlining how many notifications have been assigned, completed or are overdue.

DocRead can help

DocRead has been helping our customers managing their policies and procedures in SharePoint for over 12 years.